We continue to implement innovative ways to invest capital in the self-storage sector. In addition to our traditional acquisitions and third-party management platforms, we are growing our structured finance business. Our focus has always been on accretive growth. In total, we acquired 119 stores for $2.0 billion, investing $1.3 billion of our own capital with the balance contributed by partnerships. We added 265 stores to our third-party management platform, which means we added a new store every business day on average in 2021. And we grew our bridge loan program, originating $333 million in mortgage and mezzanine loans.

We added 119 stores to our Extra Space portfolio through acquisitions. The acquisition environment continues to be very competitive, and we are committed to only enter transactions that are accretive for our shareholders. Instead of focusing on the competitive brokered market of portfolio deals, we focus on off-market acquisitions of lease-up properties through our deep industry relationships. We purchased 66% of properties from joint venture, third party or bridge loan relationships. We also look to structure many of these transactions with joint venture partners and other creative structures, resulting in initial and stabilized yields above market levels.

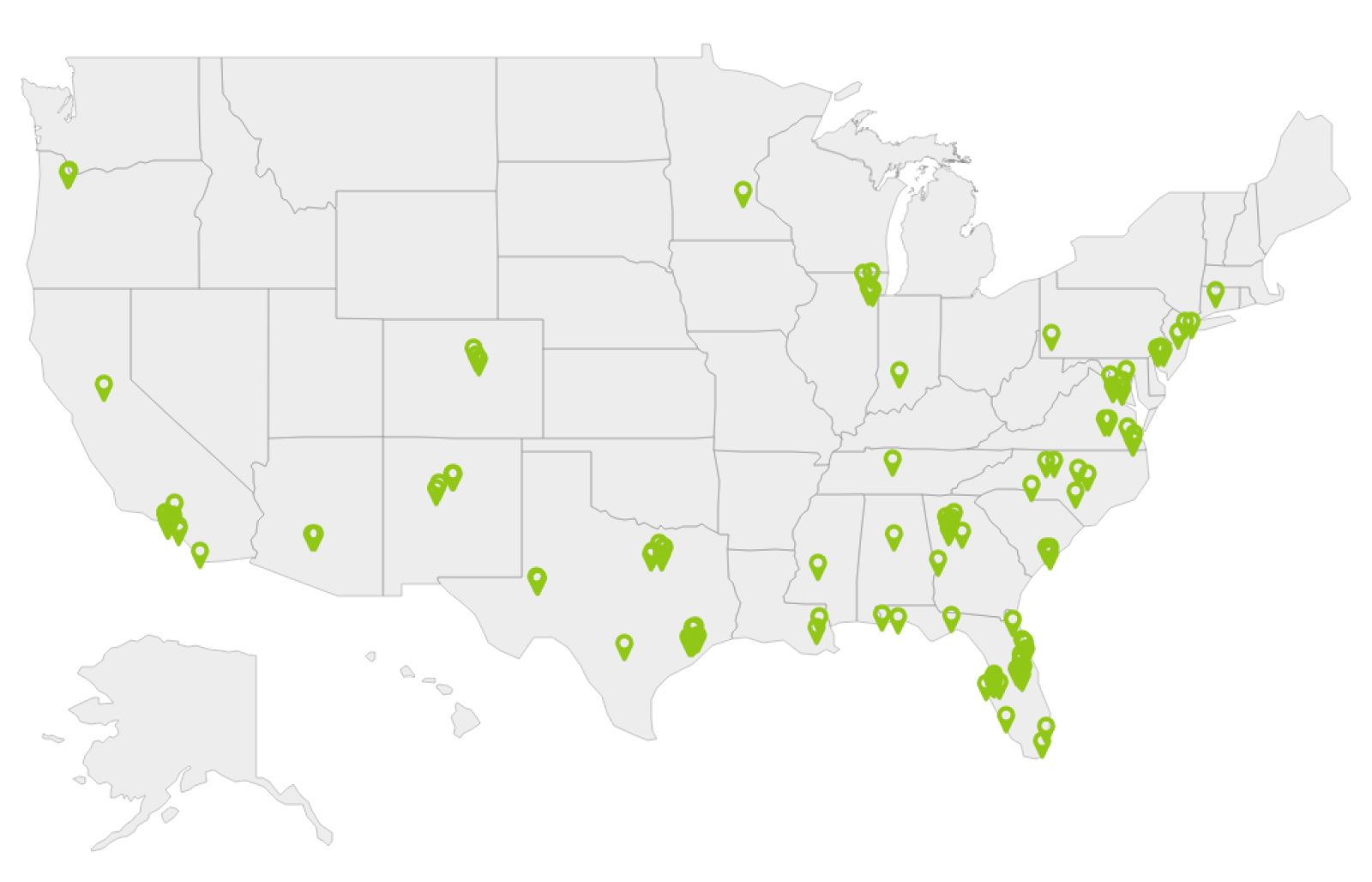

It was another very active year on the third-party management side of business, as we added 265 stores to the platform, ending the year at 828 third-party managed stores. We are the largest third-party manager in the industry, and we view our third-party management clients as partners. We nurture these partnerships for future opportunities for acquisitions, bridge loans, and other industry knowledge benefits. In addition to management fees and income from tenant insurance, our third-party management system enhances our scale and market power and provides more data for our platform.

2021 marks the third year of Extra Space’s bridge loan program and it was another year of steady growth. We originated $333 million in mortgage and mezzanine loans. This program was designed to provide loans to current and prospective third-party management customers on properties regardless of the property’s current occupancy. This deepens our relationship and offerings to these partners, adds management contracts to our platform and allows us to place capital at an attractive risk-adjusted return. It also creates a future acquisition pipeline. As we had planned, we sold a significant portion of the mortgage loans to debt partners in 2021, net origination was $156 million, with a weighted average interest rate of 9.1% on our mezzanine notes. We also acquired 13 of the properties serving as collateral for loans, totaling $161 million.