Strategy

The Best at Getting Better

Dear Fellow Shareholders,

For Extra Space Storage and the self-storage industry, 2013 was an exceptional year. We achieved record high occupancies and strong operational performance. Our outstanding execution, together with minimal new supply coming online, enabled us to deliver another year of superior results.

A key reason for our success is our commitment to continuous improvement. At Extra Space Storage, we are constantly looking for new ways to innovate, gain market share and operate more efficiently. It’s all part of our focus on being the best at getting better.

2013 Results

Same-store rental and tenant reinsurance revenues grew by 7.4%, to $345.9 million in 2013 up from $321.9 million in 2012. At the same time we kept same-store expenses in line, up 2.0% for the year, to deliver a 10.0% increase in same-store NOI. In fact, this was our second straight year of 10% NOI growth – a remarkable achievement.

Even in a weak economy, we lowered discounts and increased same-store occupancy by 130 basis points to 89.2% at December 31, 2013, compared to 87.9% as of December 31, 2012. We generated funds from operations (FFO) of $1.96 per diluted share, including a $0.07 expense related to costs associated with acquisitions, a $0.01 expense related to the Company's exchangeable senior notes and an $0.08 one-time expense for the extinguishment of debt on an acquired portfolio. Excluding these items, FFO as adjusted was $2.12 per diluted share, representing a 29.3% increase compared to 2012.

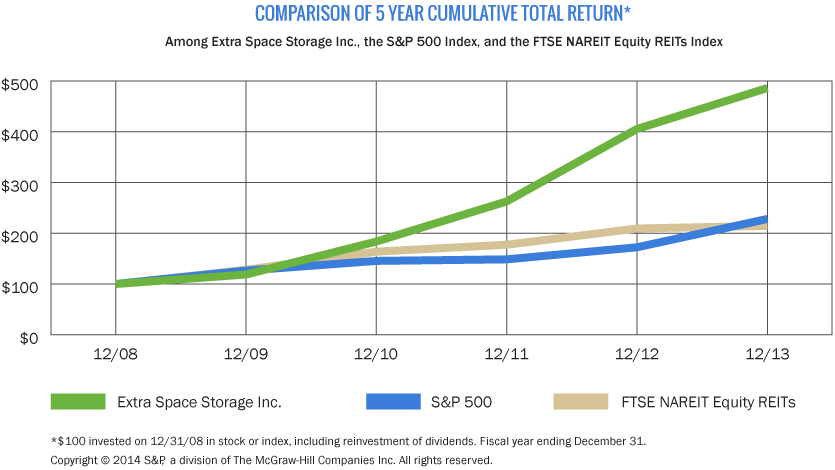

We delivered robust results by continuing to take market share from less sophisticated competitors. To reward our shareholders, we raised our quarterly common stock dividend in the second quarter by 60% to $0.40 per share, or $1.60 per share on an annualized basis.

A Year of Growth

At Extra Space Storage, it was another year of strategic growth. We purchased 78 assets for $586 million to grow our portfolio, expand our brand and create long-term value for our shareholders. We also continued to draw new owners to our proven Extra Space ManagementPlus program, which makes us the largest self-storage management company in the United States.

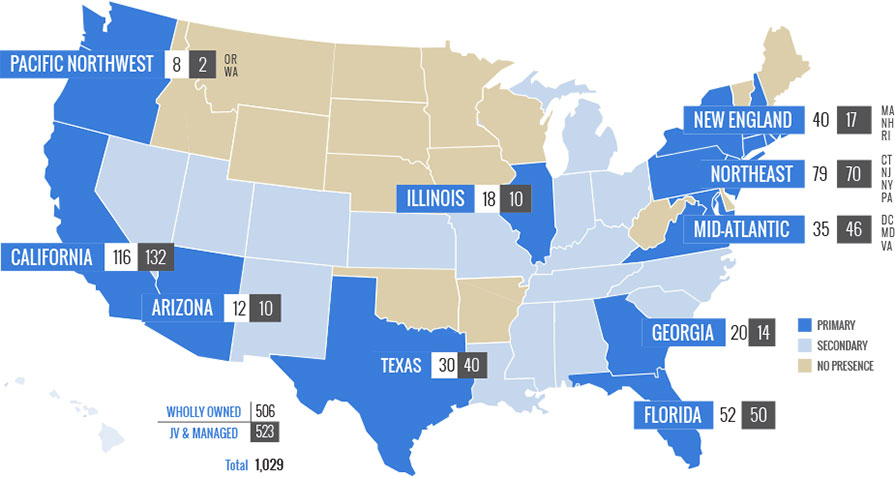

We ended 2013 with 250 properties under management for third-party owners, an increase of almost 40% for the year. Altogether, we own and/or operate more than 1,000 properties in 35 states, Washington, D.C. and Puerto Rico. As the second-largest company in the self-storage industry, we continue to grow our scale nationwide, for the benefit of our third-party owners, our joint venture partners and our shareholders.

Strong Fundamentals

As our performance shows, the fundamentals of our business remain strong. It has become even more evident that smaller operators are struggling to keep up with more sophisticated operators online, especially when it comes to acquiring customers through mobile devices.

Today, more than 60 percent of customers use the Internet to research self storage at some point during the purchase process. Over the years, Extra Space Storage has assembled an unparalleled Internet marketing team with wide-ranging expertise. Reaching customers online requires a highly specialized strategy. We bid on more than 10 million search terms a day and excel at everything from paid and organic search optimization to mobile marketing. As a result, we continue to win a disproportionate share of the market. In this kind of environment, smaller owners simply can’t compete.

Operational Excellence

At the same time, we are accelerating our business by taking full advantage of our operational excellence. With real-time data from our revenue-management system, we are able to maximize top-line growth and expense control. Across the company, we continue to innovate and to push ourselves. I would like to recognize our entire team for collaborating and committing themselves to improving on our performance.

I also want to thank Karl Haas, our former Chief Operating Officer who retired at the end of 2013, for his 20 years of dedicated service with the company. Karl will join our board of directors, and we are excited to have his successor, Samrat Sondhi, take over our field operations. Samrat has been with the Company for almost a decade, and his successes include architecting our revenue management system and leading our field operations in Chicago, New York and Los Angeles.

Looking ahead, Extra Space is positioned to have a strong 2014. As we come off two years of superior results, we see continued core growth and a favorable environment for acquisitions. We are making long-term investments that will give Extra Space the technological advantage to produce best-in-class results long into the future. I look forward to updating you on our progress in the year ahead.

Sincerely,

Spencer F. Kirk

CEO

Extra Space Storage Inc.